Is Custom Accounting Solutions the Right Fit for You?

Every business owner has different goals and challenges, and not every accounting firm is built for every situation. At Custom Accounting Solutions, we focus on partnering with business owners who want more than just compliance—they want clarity, strategy, and support that grows with their business.

We’re not here to be all things to all people. Instead, we’re built to be the right partner for the right type of business.

Our Commitment to Clients

We want you to feel confident about your financials—not overwhelmed or left guessing. That means:

• Helping you keep more of what you earn through smart tax planning

• Delivering timely and accurate financial reports you can rely on

• Giving you strategic guidance year-round, not just at tax time

Who We Work Best With

Our services are a strong fit for growth-minded business owners who:

• Run service-based, professional, or small-to-mid-sized businesses

• Generate up to $10M in annual revenue

• Want to spend less time on books and more time on growth

• Value proactive tax and accounting advice, not just year-end filings

Industries We Serve

While we support a wide range of businesses, many of our clients come from:

• Real estate and property investment

• Assisted living and healthcare businesses

• Professional services (attorneys, IT firms, consultants)

• Contractors and trades (HVAC, plumbing, electrical)

• Retail, e-commerce, and nonprofits

Who May Not Be the Right Fit

At Custom Accounting Solutions, we know we’re not the perfect match for everyone. Our goal is to build lasting partnerships where we can truly add value. With that in mind, here are a few situations where our services may not be the best fit:

For Tax-Only Services

If you’re only looking for someone to file an annual tax return, we’re not the right solution. Our approach is designed around year-round bookkeeping, planning, and strategy—not just tax season. We believe the best results come from staying connected to your numbers all year long.

For On-Site Bookkeeping or Administrative Tasks

We provide virtual accounting services and do not offer on-site support such as handling paperwork, answering phones, or running errands. If you need day-to-day in-office administrative help, an in-house bookkeeper may be a better option.

For Heavy Job-Costing Industries

If your business requires highly detailed job-costing reports or project-specific cost tracking, those needs are often better served by a dedicated in-house accountant who can work closely with your operations team.

For Very Early-Stage Startups

While we love working with new and growing businesses, our services provide the most value once you’ve established steady revenue. If you’re under $100K annually, a more basic bookkeeping setup may be the right place to start until you’re ready to scale.

When to Consider Outsourcing

Many of our clients come to us when:

• They’ve outgrown DIY bookkeeping or part-time help

• Their finances are too complex to manage alone

• They’re tired of tax surprises and want year-round planning

• They need financial clarity to make better business decisions

How to Get Started with Custom Accounting Solutions

Step 1: Initial Conversation

We’ll start with a conversation to learn more about your goals and current financial setup. This is our chance to understand the challenges you’re facing and where you’d like support. It’s also your opportunity to ask questions about our services, approach, and how we can best partner with you.

If it makes sense to move forward, we’ll request a few key documents, such as:

• Prior two years of business and personal tax returns.

• A copy of your prior year and year-to-date financial statements.

With this information, we’ll schedule an alignment call to review what we’ve found, discuss your goals, and explore how our services can help. We’ll also review pricing so you’ll have a clear picture before moving forward.

Step 2: Strategy Session

Once you’re ready to begin, we’ll set up a strategy session with your accounting team. During this session, we’ll tailor our services to your needs, outline priorities, and establish the foundation for our partnership.

We’ll also set up or optimize the right tools—such as QuickBooks Online and other cloud-based systems—so your accounting processes are accurate, efficient, and streamlined. As part of this process, we’ll review and clean up your books to ensure everything is ready for ongoing reporting and tax compliance.

Most new clients receive their first financial reports from us within 30–60 days of this session.

Step 3: Moving Forward Together

By the end of the strategy session, you’ll know exactly what to expect, how we’ll work together, and what the next steps look like. Our goal is to give you the financial clarity and confidence you need to focus on running—and growing—your business.

We’re excited to be part of your success story.

Our Service Packages

We offer three tiers to meet you where you are in your business journey:

• Bookkeeper – Foundational → Reliable bookkeeping, tax filings, and compliance for early-stage businesses

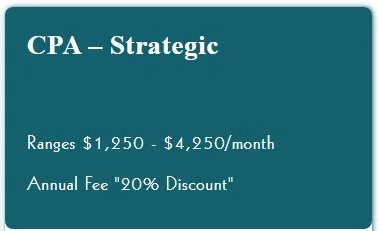

• CPA – Strategic → Deeper insights, tax planning, and financial guidance for growing companies

• CFO – Forecasting → Advanced forecasting, cash flow management, and CFO-level strategy for established businesses

Ready to See If We’re the Right Fit?

If this sounds like your situation, let’s talk. We’ll start with a discovery call to understand your business, review your current setup, and outline how our team can help you reach your goals.